In the crypto world Futures Trading, "fear of heights and fear of lows" (the fear of shorting at high positions or going long at low positions) is a common psychological barrier, stemming from the fear of extreme market Fluctuation and cognitive bias. This mindset can easily lead to missed opportunities or erroneous operations. Here are specific analyses and coping suggestions:

---

### **1. Why do fears of high and low occur?**

1. **Anchoring Effect**

- Overly focusing on historical prices (e.g., "Bitcoin once dropped to $3000" or "rose to $69000"), believing that the current high/low pric

View Original---

### **1. Why do fears of high and low occur?**

1. **Anchoring Effect**

- Overly focusing on historical prices (e.g., "Bitcoin once dropped to $3000" or "rose to $69000"), believing that the current high/low pric

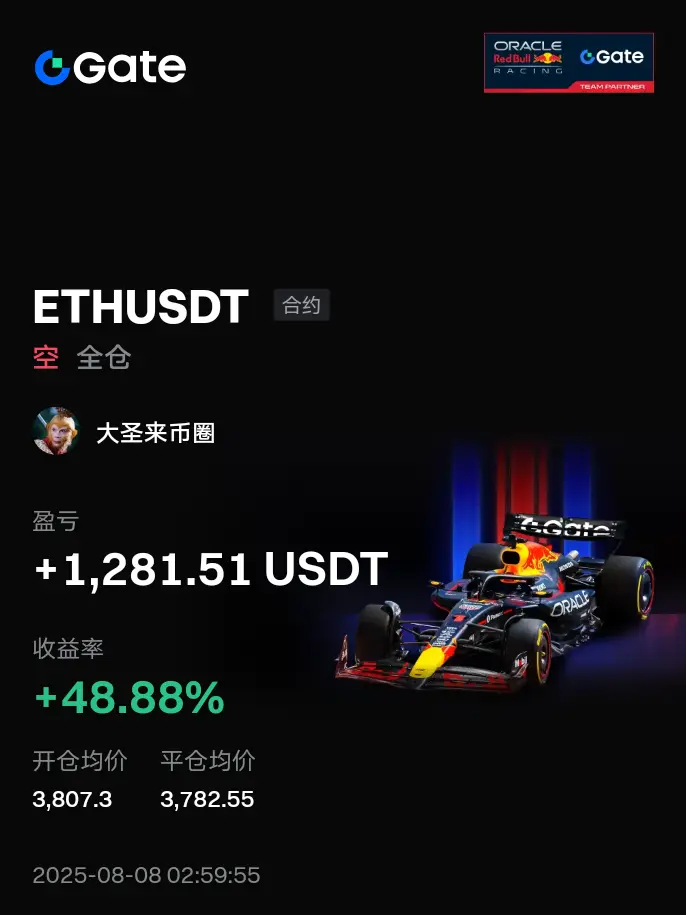

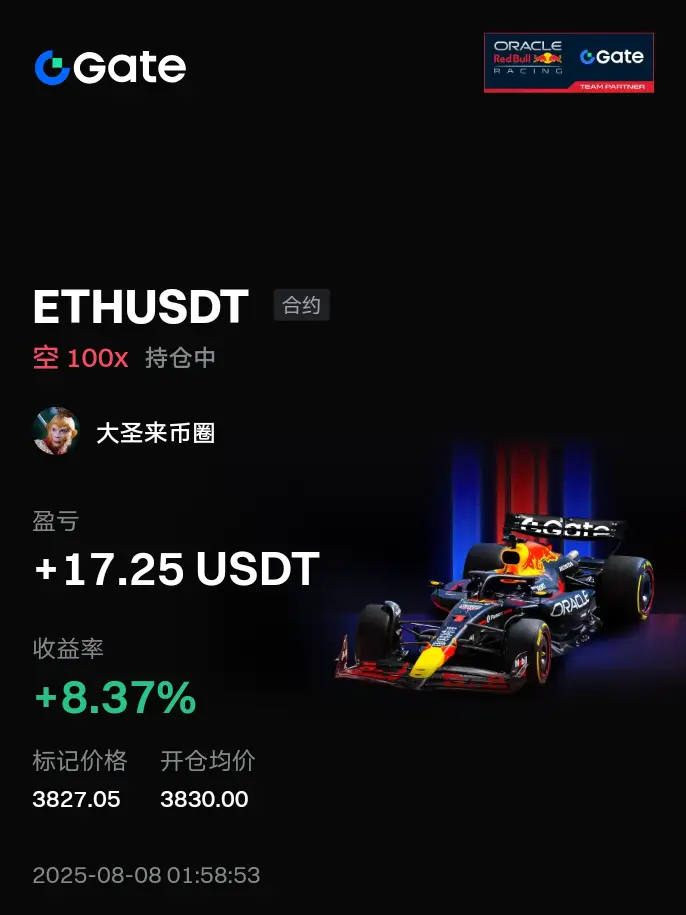

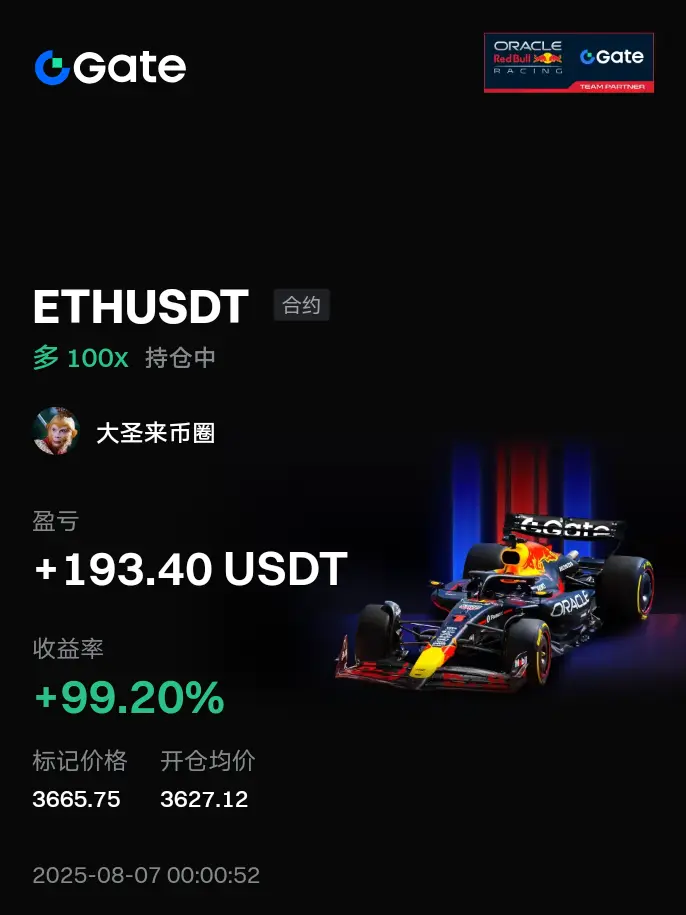

[The user has shared his/her trading data. Go to the App to view more.]