GUSD: Gate Launches a Stable Wealth Management Option Backed by Real-World Assets

What is GUSD?

Image: https://www.gate.com/staking/USDT?pid=33

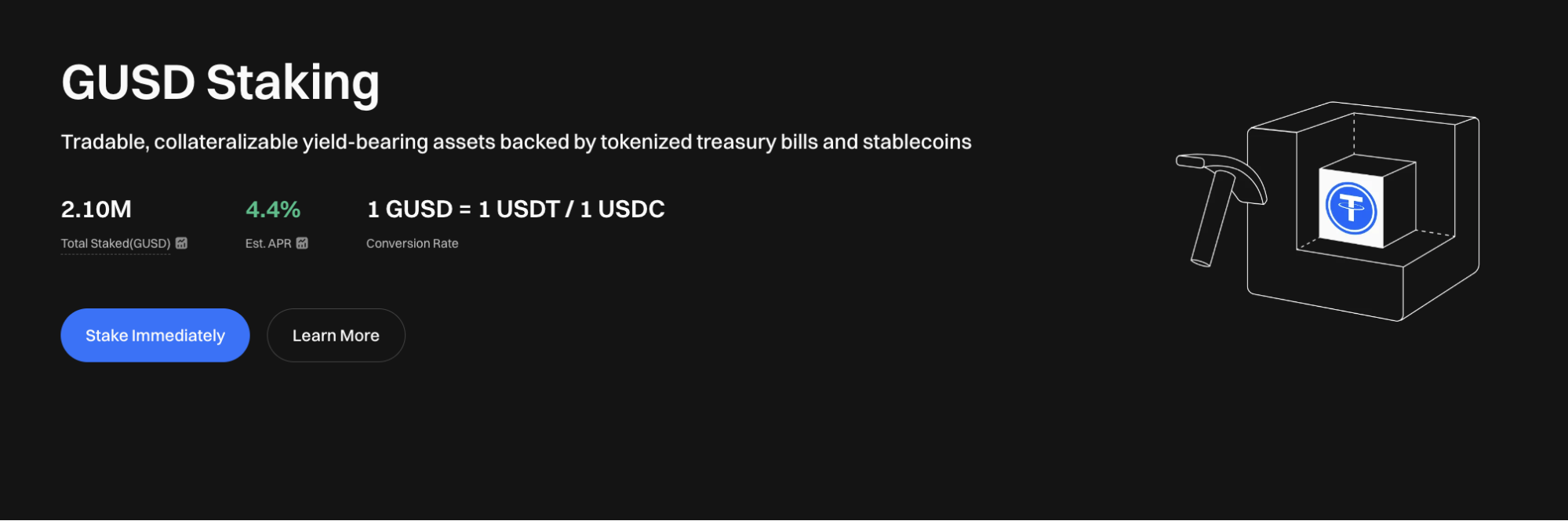

Against the backdrop of high market volatility in crypto, investors are increasingly seeking stable yield products. In August 2025, Gate officially launched GUSD. It is an innovative investment product backed by real-world assets (RWA). Unlike traditional stablecoins, GUSD isn’t just a digital stand-in for cash; it is an interest-bearing certificate supported by low-risk financial assets such as U.S. Treasury bonds.

Users can easily exchange USDT or USDC for GUSD at a 1:1 ratio, enabling them to indirectly allocate funds to U.S. Treasuries and other traditional financial instruments, and earn a stable interest yield in USD.

Core Advantages of GUSD

Key differentiators include:

- Stable Yield: Offers an initial annualized yield of 4.40%, with far less volatility than money market products, making returns much more predictable.

- Asset-Backed: Backed by low-risk assets including U.S. Treasuries, reducing risk to principal.

- Flexible Minting: Supports both USDT and USDC for minting, giving users more flexibility.

- Security and Transparency: Audited proof of reserves is planned to further enhance transparency and user trust.

Minting and Redemption Mechanism

The GUSD process is simple and straightforward:

- Minting: On Gate’s “On-Chain Earn” page, swap USDT or USDC at a 1:1 ratio for GUSD. Individual accounts have a limit of 5 million, while institutional users can apply for up to 10 million.

- Yield Accrual: Holding GUSD automatically accrues daily passive income, which is credited directly to your main account for potential compounding growth.

- Redemption: Users have two redemption options:

- Standard Redemption: 0.05% fee, settlement in D+3 business days;

- Quick Redemption: 0.1% fee, funds typically credited within 10 minutes.

Yield Sources and Risk Analysis

GUSD’s yield primarily comes from U.S. Treasury interest plus a portion of earnings from the Gate ecosystem. This results in significantly lower volatility compared to on-chain staking or high-yield crypto products.

Potential risks include:

- Fluctuations in U.S. Treasury yields, which can impact overall returns;

- Custodial credit risk—while the chance is very low, it remains something to monitor.

Compared to the highly volatile crypto lending space, GUSD uses the RWA model to link user funds with traditional financial markets. This approach strikes a balance between yield stability and principal security.

Why Choose Gate’s GUSD

As a global leader in crypto, Gate manages over $4 billion in wealth management assets. With the launch of GUSD, Gate extends its strengths in compliance and security, while delivering even more flexible product features:

- Supports minting with multiple stablecoins;

- Redemptions are paid out in USDC, a stablecoin widely regarded as the closest equivalent to a digital dollar, boosting user confidence;

- Transparent yields, with plans to provide audited reserve reports.

For users seeking reliable returns in volatile markets, GUSD offers a reliable option for stable yields.

Frequently Asked Questions (FAQ)

Q1: Is GUSD the same as Gemini Dollar?

No. Gate’s GUSD is an RWA-based interest-bearing certificate, entirely distinct from the Gemini stablecoin.

Q2: Why is the yield lower than Yu’e Bao?

Yu’e Bao depends on crypto lending, which is highly volatile. GUSD’s 4.4% comes from U.S. Treasury interest, offering stable and reliable returns more suitable for long-term holdings.

Q3: Why can GUSD only be redeemed in USDC?

USDC offers greater compliance and transparency, being backed by U.S. dollar deposits and short-term Treasuries, and is widely considered the closest stablecoin to a true digital dollar.

Q4: How do I choose a redemption method?

If you need funds urgently, opt for quick redemption. If you’re not in a rush, the lower-fee standard redemption is the better choice.

Summary

Gate’s GUSD is an RWA-driven innovation that secures principal while reliably delivering stable USD-denominated returns. By bridging traditional finance and crypto, it provides a low-risk approach to digital wealth management.

GUSD may be a suitable choice for investors seeking consistent returns and reduced risk.

Related Articles

Gate Alpha Phase 9 Points Airdrop: Limited-Time WAI Claim with Just 127 Points

USD1 Points Program Pre-Launch Raffle: Win up to 1,000 USD1

Gate Launchpad Guide: Secure Early Access to Promising Crypto Projects

Gate USD1 Multi-Scenario Points Campaign: Trade, Hold, and Earn Rewards Across the Ecosystem

Ethereum Price Breaks $4,700 Nearing All-Time High, Gate ETH Staking Offers 4.87% Stable APY